![Rental Industry Statistics - Market size + Speculation [2023]](/resources/content/images/size/w1384/2023/09/Rental-Industry-Statistics.jpg)

Rental Industry Statistics - Market size + Speculation [2023]

Explore the latest Rental Industry Statistics for 2023: Market Size, Trends, and Speculation.

Welcome you all to the world of rental statistics.

We have listed a collection of statistics on various niches within the rental industry.

Some of the industry comes with data, and for others, we have given speculation on the future growth.

Quick Links:

- Vacation rental industry statistics

- Car rental industry statistics

- RV rental statistics

- Apartment rental statistics

- Party rental industry statistics (US)

- Bounce house rental statistics

- Equipment rental statistics

- Boat rental statistics

- Dumpster rental statistics

- Kayak rental statistics

- Formal wear & costume rental statistics

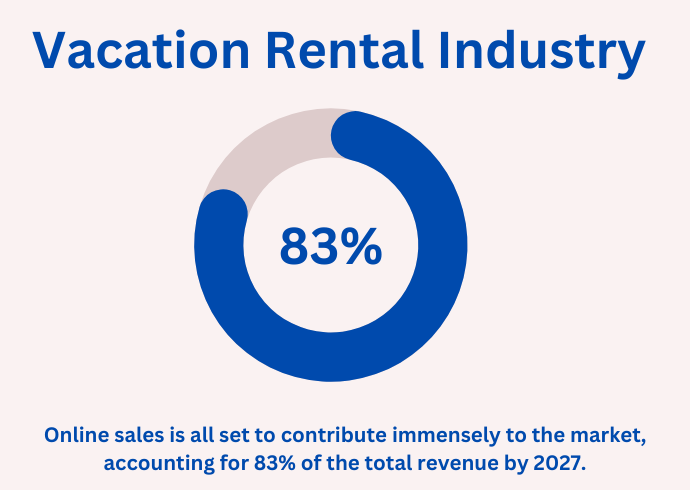

1. Vacation Rental Industry Statistics

-

The vacation rental market is anticipated to reach a revenue of approximately US$19.39 billion in 2023, with an expected annual growth rate (CAGR 2023-2027) of 1.49%.

-

The projected market size will be about $20.57 billion by 2027.

-

The average revenue per user (ARPU) is expected to be around US$311.10.

-

By 2027, the number of users in the Vacation Rentals market will reach approximately 62.99 million.

-

User penetration in this market is forecasted to be 18.3% in 2023, gradually decreasing to 18.1% by 2027.

-

Online sale is all set to contribute immensely to the market, accounting for 83% of the total revenue by 2027.

-

When considering global comparisons, the United States will generate the highest revenue, with an estimated US$19.39 billion in 2023.

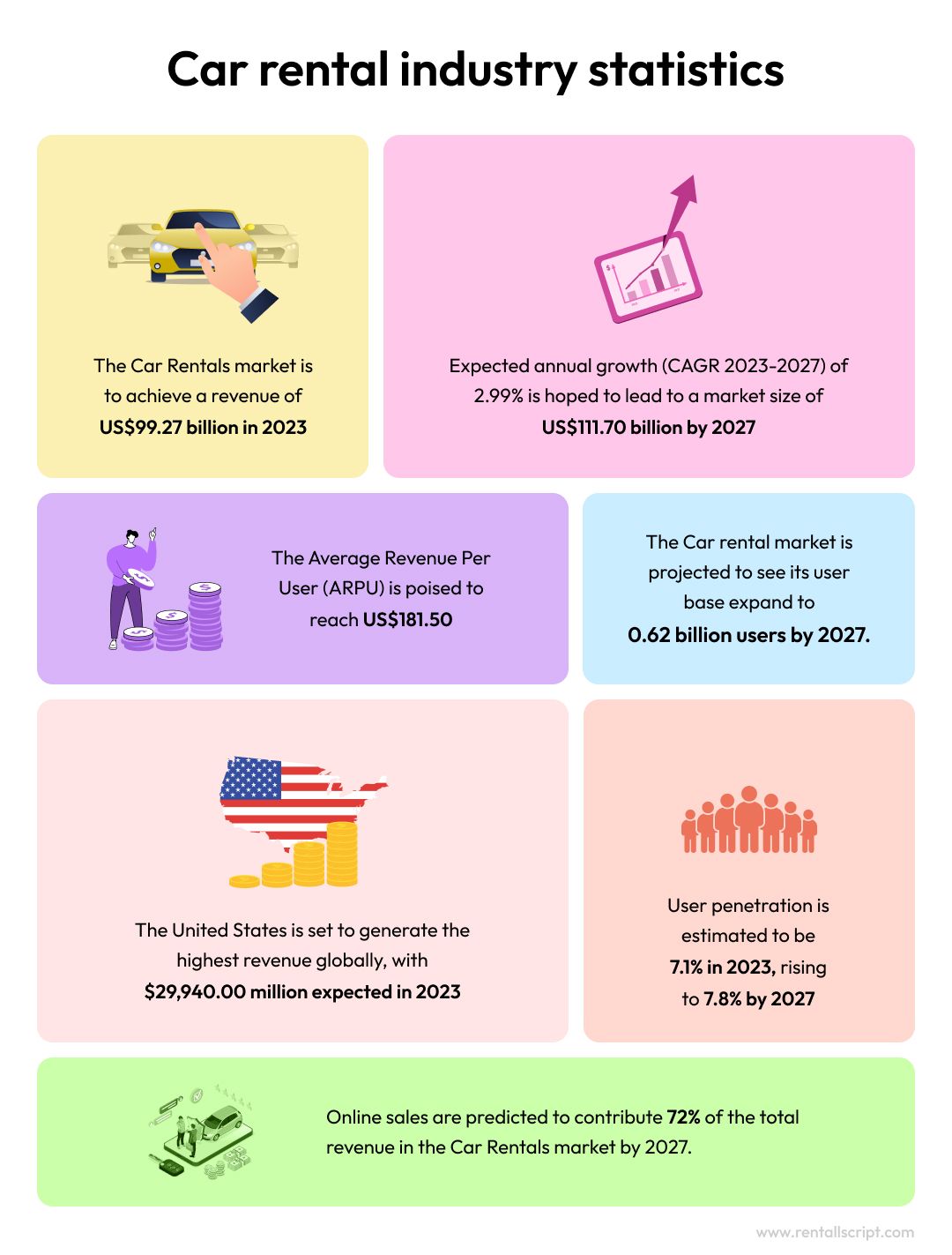

2. Car Rental Industry Statistics

-

The Car Rentals market is to achieve a revenue of US$99.27 billion in 2023.

-

Expected annual growth (CAGR 2023-2027) of 2.99% is hoped to lead to a market size of US$111.70 billion by 2027.

-

The Average Revenue Per User (ARPU) is poised to reach US$181.50.

-

The Car rental market is projected to see its user base expand to 0.62 billion users by 2027.

-

User penetration is estimated to be 7.1% in 2023, rising to 7.8% by 2027.

-

The United States is set to generate the highest revenue globally, with $29,940.00 million expected in 2023.

-

Online sales are predicted to contribute 72% of the total revenue in the Car Rentals market by 2027.

3. RV Rental Statistics

-

The RV and camper van rental sector generated $824.4 million in sales in 2022.

-

Even though the overall revenue may represent a positive look, the industry has experienced a slight decline of 0.5% in its market size during the same year.

-

Over the five years of 2017 to 2022, the RV and camper van rental sector in the United States displayed consistent growth, averaging an annual increase of 3.9%.

4. Apartment Rental Statistics

-

In 2023, the Apartment Rental industry in the US boasts a market size of $251.1 billion.

-

Market concentration within the US Apartment Rental industry remains low, as the top four companies collectively account for just 32% of market revenue in 2023.

-

While competition levels are generally low across the industry, smaller players face the highest level of competition.

5. Party Rental Statistics(US)

-

The value of the party supply rental industry is at $6.3 billion in 2023.

-

Over the past five years, industry revenue has grown at a CAGR of 1.1%, reaching an estimated $6.3 billion in 2023.

-

Key drivers for the US Party Supply Rental market include per capita disposable income, marriage rates, corporate profits, demand from trade shows and conference planning, and the national unemployment rate.

-

Market share within the US Party Supply Rental industry is relatively low, with the top four companies contributing less than 40% of total industry revenue.

-

The Party Supply Rental industry in the United States employs 56,854 people as of 2023.

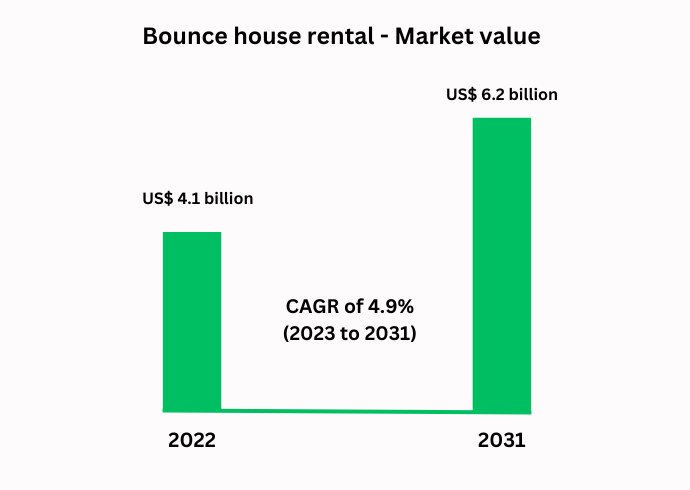

6. Bounce House Rental Statistics

Statistics

The global bounce house market was valued at US$ 4.1 billion in 2022 and is projected to grow at a CAGR of 4.9% from 2023 to 2031, reaching US$ 6.2 billion by 2031.

Around this period, North America is expected to dominate the market, with Asia Pacific also experiencing steady growth.

Overall analysis

The global bounce house market is experiencing substantial growth driven by changing lifestyles, demand for affordable bounce houses, and the increasing preference among kids.

In particular, bounce houses are becoming popular at birthday parties, social events, and entertainment parks.

In the meantime, the adoption of bounce houses in shopping malls and entertainment parks has created opportunities for market players.

When we go by the country, the Asia Pacific is emerging as a significant market due to lifestyle improvement and popularity.

Europe is experiencing growth, while North America is set to be a major market.

Market players are focusing on innovation, product expansion, mergers, and acquisitions to strengthen their positions in the industry.

7. Equipment Rental Statistics

In 2022, the United States equipment rental market reached a valuation of $52.7 billion.

However, this market faced a significant setback in 2020 amid the COVID-19 pandemic. But, it rebounded in 2021 with a 3% growth, reaching $47.8 billion.

According to projections, the US equipment rental sector will surpass the record levels seen in 2019.

The global equipment rental market generated $87.5 billion in revenue in 2019.

The North American equipment rental market is predicted to recover to its pre-crisis levels by 2023, after dropping to $53.2 billion in 2020.

8. Boat Rental Statistics

The global boat rental market was valued at $18.2 billion in 2021 and is projected to reach $31.2 billion in 2031, registering a CAGR of 5.7%.

The leading players in the boat rental market are BoatJump USA Inc., Brunswick Corporation, Click&Boat, GetMyBoat, Boatsetter, Blue Boat Company, Globe Sailor, Groupe Beneteau, Nautal, Sailo, and Zizooboats GmbH.

Speculation

The global maritime tourist business is predicted to grow significantly in the future years.

Recent trends indicate a surge in sea-based tourist activities, including boating, cruising, yachting, and nautical sports.

The World Economic Forum's analysis forecasts a 3.5% global growth rate in maritime and coastal tourism by 2030.

As the growth rate is expected to surge, governments worldwide are taking initiatives to strengthen maritime travel and tourism.

Another key factor driving the boat rental market's growth is the advent of online platforms for booking boats.

Collaborations between service providers and travel agencies have led to combined luxury packages, therefore enhancing the appeal of boat rentals.

9. Dumpster Rental Statistics

In 2022, the Dumpster Rental industry was valued at $557.6 million. It shows that the market size has increased by 3.5% in 2022.

In the US, the market size of the Dumpster Rental industry has grown 2.0% per year on average between 2017 and 2022.

Speculation

Residential building, like commercial construction, generates a lot of waste products. As a result, this factor is more likely to boost and increase waste management demand, and it could benefit the dumpster rental companies.

Unluckily, the value is yet to decrease in 2023. But it is expected to surpass the past high in the future.

10. Kayak Rental Statistics

-

In 2022, the Kayak Rental industry generated $56.7 million in revenue.

-

During 2022, the market size of the kayak rental industry fell by 1%.

-

Between 2017 and 2022, the Kayak Rental sector in the United States revealed an average annual growth rate of 1.0%.

11. Formal Wear & Costume Rental Statistics

In 2022, the Formal Wear & Costume Rental industry in the United States had a market size of $691.4 million.

During the same year in the United States, the industry employed 5,047 individuals.

In terms of market share, the top four companies contributed only 32% of the total market revenue in 2022, which displays a low level in the US.

That’s all.

Keeping an eye on these statistics can provide valuable insights for businesses and enthusiasts.

Whether you're up to start a rental business, or an investor looking for opportunities, these numbers offer a glimpse into the exciting potential of the rental industry.

As we move forward, we want to express our gratitude to sites like IBISWorld and Statista, where we collected most of our valuable insights.